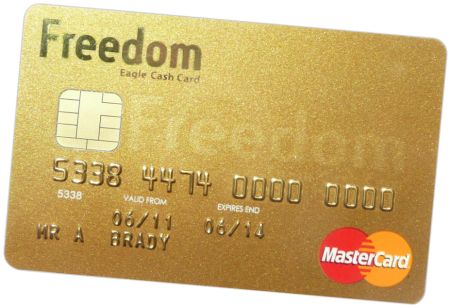

Earn 3% on dining and restaurants, including takeout and eligible delivery services. Enjoy 5% on travel purchases through Chase Ultimate Rewards. The card offers a $200 bonus after you spend $500 on purchases in the first 3 months from account opening. Depending on how you redeem them from there, you could potentially get even more value out of your points.įinally, the card can be worth it for people looking for a relatively long introductory 0% APR promotion on purchases and a bonus that won't break the bank to earn.Ĭhase Freedom Unlimited Credit Card Bonus The three cards mentioned also allow you to transfer your points to select airline and hotel loyalty programs at a 1:1 ratio. For instance, with the Chase Sapphire Preferred and the Ink Business Preferred Credit Card, you'll get 25% more value when you redeem your rewards for travel through Chase, and the Chase Sapphire Reserves gives you 50% more. It's especially worth considering if you have other cards that earn Chase Ultimate Rewards points since you can pool your points from all such cards to squeeze more value out of them. If you're looking for a top-of-wallet credit card that won't require extra legwork to maximize its value, this one should be on your radar. The Chase Freedom Unlimited is designed for people who want a relatively simple rewards program that pays solid returns along with some compelling new bonus earning categories.

#Freedom unlimited credit card plus

For example, the Citi Double cash card, which also has no annual fee, provides 1% cash back on purchases plus 1% cash back when you pay your balance.

0 kommentar(er)

0 kommentar(er)