“Inflation will continue to have an impact as we move into fiscal year 2023,” says Weidner.

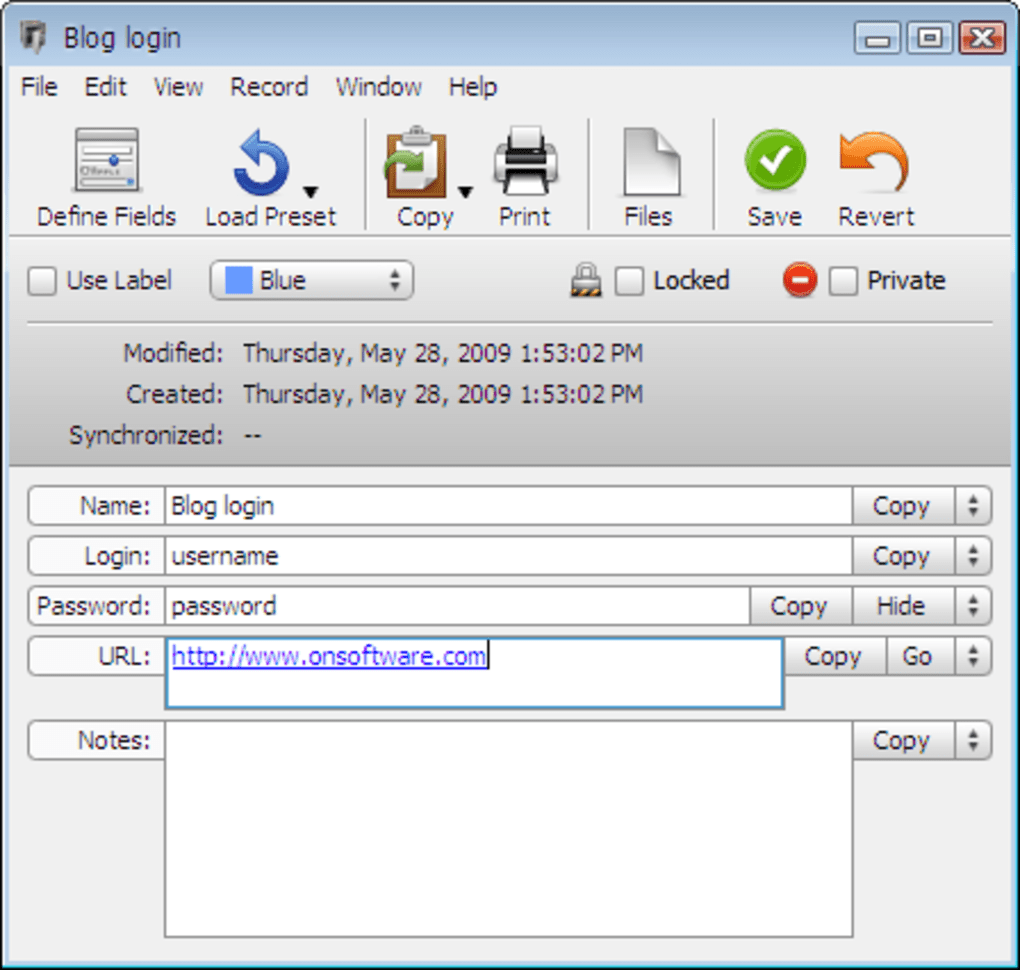

DATA GUARDIAN WINDOWS LINES KEYGEN

In addition to supply, inflation remains a huge headwind for customers of float companies in North America. As of this writing, the only addition to North American float supply is coming from Vitro, which is in the process of adding a third float line to its Garcia float plant located near Monterrey, Mexico.Ĭanadian Premium Sand, a silica sand producer, now in the process of planning and constructing a new solar glass facility in Selkirk, Manitoba, has no specific plans to include traditional float lines at this time, says President Glenn Leroux, though future phases of development could see an expansion of glass product types, depending on market demand. “With the COVID restrictions and the lockdowns, the periodic opening and reclosing, the amount of glass coming out of China was severely restricted around the world,” he says.ĭespite the gap in domestic supply, no significant new float construction is likely, Weidner says, due to the cost and lead times of raw materials needed for a new plant. This last year, that supply was severely restricted due to China’s continued COVID lockdowns. NSG’s Weidner estimates that about three float lines worth of glass are imported offshore, comprising about 8 percent of total supply in North America. Glass Magazine’s Top Glass Fabricators survey, which gathered responses from leading fabricators in North America, found that 95 percent of domestic fabricators sourced raw glass from North America in 2021, 24 percent from Europe and 18 percent from Asia. The strain on domestic supply hits downstream companies hard, as most raw glass comes from North American manufacturers. “That equates to almost a need for a new float not exactly every year, but every other year,” he says.

Stephen Weidner, president and head of Architectural Glass North America and Solar Products Groups, NSG Pilkington, says that market demand continues to grow about 2 to 3 percent per year. Glass demand is likely to again outstrip domestic glass production in North America in this new year. North American supply to remain tight in 2023 As floats come online, change hands or go offline, companies mitigate shorter-term instability, while also planning for long-term success by exploring sustainable solutions. These challenges piled on top of a situation that was already complicated by continued supply issues from a global pandemic. The conflict has severely affected energy supply to Europe, causing the price of natural gas to surge, further adding to costs and causing cascading effects around the world. The Russian invasion of Ukraine in February, an ongoing conflict which as of this writing does not have an end in sight, destabilized lives, countries and industries.

For the global glass industry, 2022 was a dramatic year, to say the least.

0 kommentar(er)

0 kommentar(er)